Sights expressed are as on the date indicated, based on the data readily available at that time, and could alter depending on sector or other circumstances.

As an personnel, you are able to contribute your whole income so long as it will not exceed the yearly highest contribution. Given that the owner, you may make contributions given that the employer up to your mentioned boundaries (see below).

5% continual serious wage expansion, a retirement age of sixty seven in addition to a planning age by means of 93. The substitution once-a-year cash flow goal is outlined as forty five% of pre-retirement once-a-year revenue and assumes no pension revenue. This focus on is predicated on Client Expenditure Study (BLS), retirement Figures of Revenue Tax Stat, IRS tax brackets and Social Stability Reward Calculators. Fidelity developed the income multipliers by means of a number of current market simulations determined by historic industry info, assuming very poor current market ailments to assist a ninety% self esteem volume of results.

An inheritance is actually a percentage of belongings offered into the heirs on the deceased, which an heir can use as earnings for retirement. However, since the estates of homeowners that die have not exchanged hands because possession, they should still be topic to tax, no matter if state or federal (In the U.S., combined with the mandatory federal estate tax, 6 states mandate the payment of the different inheritance tax).

The price cut fee used to compute the existing value of liabilities is frequently based on significant-excellent company bond premiums. International companies adhering to IFRS deal with equivalent prerequisites, with some discrepancies in legal responsibility measurement and disclosure.

David Kindness is usually a Qualified Community Accountant (CPA) and a specialist while in the fields of monetary accounting, corporate and personal tax planning and preparation, and investing and retirement planning.

A 403(b) is a powerful and well-known way to avoid wasting for retirement, and you may agenda the money to get mechanically deducted from a paycheck, aiding you to check here avoid wasting far more proficiently.

Easy accessibility to funds: Funds inside of a brokerage account may be accessed fairly speedily. Compared with most employer-sponsored retirement plans that Restrict entry to resources although Doing work or Have a very penalty for early withdrawal, there isn't a such restriction or age-similar penalty for withdrawing funds from the brokerage account.

This calculator can help with planning the monetary aspects of your retirement, including delivering an idea where you stand with regard to retirement price savings, simply how much to avoid wasting to reach your goal, and what your retrievals will appear to be in retirement.

It is just a violation of law in some juristictions to falsely discover by yourself within an e mail. All details you present are going to be employed solely for the objective of sending the e-mail on your own behalf. The subject line of the e-mail you deliver will likely be “Fidelity.com”.

The calculations here can be beneficial, as can a number of other retirement calculators on the market. It can also be useful to speak with accredited pros who support people plan their retirements.

Underneath a SEP, an worker need to arrange an IRA to accept the employer's contributions. Businesses may perhaps no more set up Wage Reduction SEPs. Nonetheless, businesses are permitted to determine Easy IRA plans with income reduction contributions. If an employer experienced a salary reduction SEP, the employer may possibly go on to allow salary reduction contributions into the plan.

Remember that investing entails risk. The worth of the expenditure will fluctuate with time, and you might gain or lose dollars.

We also reference initial investigate from other reliable publishers where proper. You could find out more in regards to the specifications we observe in producing accurate, unbiased content material in our

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Erik von Detten Then & Now!

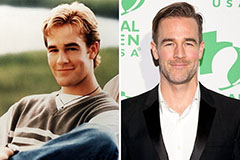

Erik von Detten Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!